The loan underwriting process is an important process that determines whether a loan application should be approved or not. If you have a high credit score, the bank or lender is likely to approve your application. A good credit score reflects your ability to manage your finances. You are making a good amount of money and paying a healthy down payment, your loan application will be approved and you will have to pay a low interest rate.

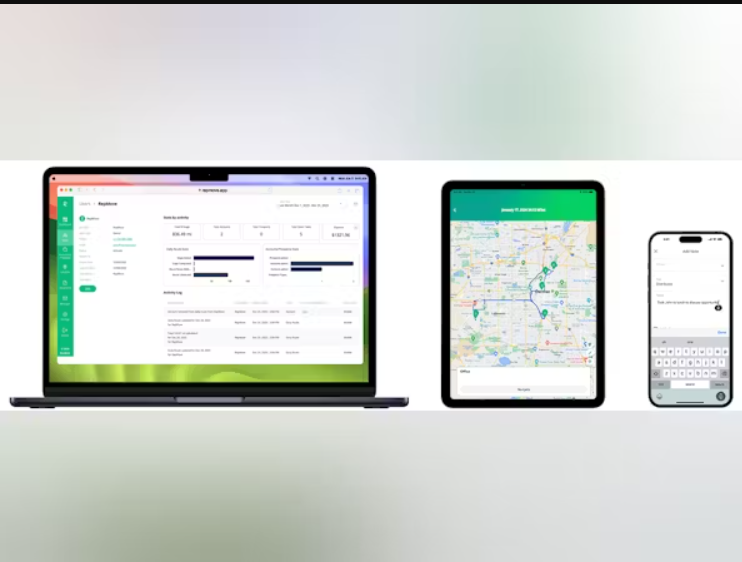

Before you apply for a home loan or any other loan, it is good for you if you learn how a bank processes your loan application. Banks use an underwriting system to automate the loan underwriting process.

An underwriting system automatically declines an application with a low credit score, bad credit history and unstable income. You can manually check the chances of your loan application approval.

Most lenders use an underwriting system for decision making in the loan origination process.

They have specific criteria for loan approval. Your credit score should not be below a certain level. This level is not the same for all lenders. The loan application of an applicant with a credit score below that level is declined. A typical lender sees if your debt to income ratio is above 43% or not. However, defining income is a little tricky. The lender may not be able to accurately calculate your income.

An underwriting system makes it easy to manage documents, do calculations and ensure that the loan meets regulations.

The following factors can affect your loan application:

A Debt Free Lifestyle

An underwriter or underwriting software needs data to analyze your application. This requires a history of borrowing and loan payments. Some people want to live a debt-free life. They want to avoid interest to save money. However, you are not creating a credit history. A blank credit report or a credit report with only a few entries does not tell anything about your ability to make timely payments. You don’t have a credit profile. However, this does not necessarily mean that you have bad credit. This is still better than having collections, bankruptcy and other negative items on your credit report.

New Credit

It takes several years to build credit. If you don’t have a robust credit profile, you can request the lender to process your application manually. You can also add a loan to your credit report and start making timely payments. This can improve your credit score fast. Having a mix of loans is also good for your credit profile.

Recent Financial Problems

If you have filed bankruptcy, it is difficult to get a loan but not impossible. You can apply for a loan after one or two years. A lender may approve your loan application. If you have gone through some financial difficulties recently and once again achieved a stable income to make loan payments, you can request the lender to process your application without using an underwriting system.

Debt to Income Ratio

Make more and spend less. In addition to the loan underwriting process, your debt to income ratio is also used to calculate your credit score.